Introduction: When an Emergency Happens on a Sunday

Financial emergencies don’t wait for office hours. A sudden medical bill, urgent car repair, or an overdue payment can happen on a Sunday, when banks and most lenders are closed.

If you’re searching for an emergency cash loan on Sunday in Singapore, it’s important to know what your legal and safe options are — and what to avoid.

This guide explains your choices clearly, so you can make the right decision without putting yourself at risk.

Why Sundays Are the Hardest Day to Get a Loan

In Singapore, most banks and licensed moneylenders operate Monday to Saturday only. Sundays are typically reserved for rest days, leaving borrowers with limited access to legitimate credit.

This gap often leads to:

Delayed bill payments

Missed work opportunities

Increased stress and anxiety

Worse, it may push desperate borrowers toward illegal moneylenders, which can cause long-term financial and personal harm.

Your Main Options for an Emergency Cash Loan on Sunday

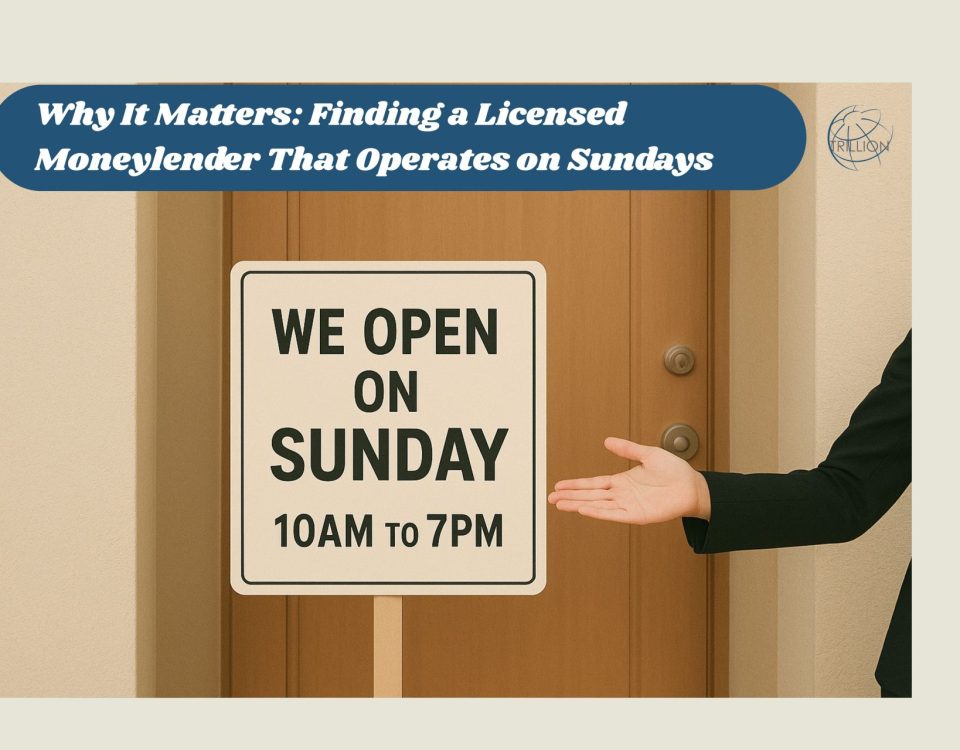

1. Licensed Moneylenders Open on Sundays (Best Option)

A small number of licensed moneylenders in Singapore operate on Sundays, specifically to help borrowers during urgent situations.

✅ Same-day assessment

✅ Legal and regulated under Singapore law

✅ Transparent interest rates and repayment terms

✅ Cash disbursement on the same day

If you need money urgently on a Sunday, this is the safest and most reliable solution.

2. Borrowing from Family or Friends

This may work for some, but it’s not always practical.

Not everyone has immediate access to help

Personal relationships may be affected

Amounts may be insufficient for urgent needs

While it’s an option, it isn’t always reliable in true emergencies.

3. Credit Cards or BNPL (If Available)

If you have available credit limits, you may be able to use:

Credit Cards

Buy-Now-Pay-Later services

However:

Your Credit Card limit may not be sufficient

BNPL may not cover cash needs

Approval is not guaranteed

These are only viable if you already have access.

4. What You Should Avoid: Illegal Moneylenders

Never turn to unlicensed moneylenders — especially on weekends.

Illegal moneylenders often:

Advertise via WhatsApp or SMS

Offer “guaranteed approval”

Charge excessive interest

Use harassment or threats

Borrowing legally protects you under Singapore’s Moneylenders Act and oversight by the Registry of Moneylenders.

How a Sunday Emergency Loan Works

If you approach a licensed moneylender open on Sunday, the process is straightforward:

Apply online or walk in on Sunday

Submit required documents (NRIC, payslips, proof of employment)

Receive a loan offer within minutes

Sign a regulated loan contract

Collect your funds on the spot

Common Situations Where a Sunday Loan Helps

An urgent Sunday cash loan is commonly used for:

Medical or dental emergencies

Vehicle breakdowns affecting work

Overdue rent or utility bills

Salary delays

Family emergencies

In these moments, timing matters more than anything else.

Why Borrowers Choose Licensed Sunday Moneylenders

Borrowers look for Sunday-operating licensed moneylenders because they offer:

Immediate solutions when others are closed

Legal protection and transparency

No hidden fees or surprise charges

Clear repayment schedules

Most importantly, borrowers get help without risking their safety or financial future.

What to Prepare Before Applying on a Sunday

To speed things up, simply prepare:

NRIC

Latest payslips or residential proof (only for foreigners)

Singpass

Being prepared helps ensure faster approval and smoother processing.

Conclusion: Act Fast, But Borrow Safely

If you’re facing an emergency and asking, “Where can I get an emergency cash loan on Sunday in Singapore?” — the answer is clear:

Choose a professional licensed moneylender like Trillion Credit that opens on Sunday, not shortcuts that lead to long-term problems.

Urgent situations require fast action, but safe and legal borrowing should always come first.

📞 Need urgent cash today?

Walk in to our branch this Sunday or apply online anytime.

We’re here to help — legally, transparently, and when you need it most.

📱 Call us at 65090111

📝 Or apply now at https://trillioncredit.com.sg/apply-for-loan/